The Employees’ Provident Fund ( EPF ) Scheme, 1952

Background

On 15th November, 1951, the Employee Provident Fund (EPF)came into existence with the promulgation of the Employees’ Provident Funds Ordinance Later on, in the year 1952, the Parliament passed Bill Number 15 namely Employees’ Provident Funds Bill to provide for the institution of provident funds for employees in factories and other establishments and the Employee Provident Fund (EPF) & Miscellaneous Provisions Act, 1952 came into existence, which replaced the Employee Provident Fund (EPF) Ordinance. This Act and the schemes made there under extend to the whole of India except Jammu and Kashmir and are administered by a tri-partite Board known as the Central Board of Trustees, Employee Provident Fund, consisting of representatives of Government (Both Central and State), Employers, and Employees.The three schemes operated under the this Act are – EPF Scheme 1952, Pension Scheme 1995 (EPS) and Insurance Scheme 1976 (EDLI).

Applicability of EPF

For the purpose of applicability of The Employees’ Provident Fund (EPF) Scheme, 1952, two conditions are required to be fulfilled:

- The establishment must be a factory engaged in any industry specified in Schedule 1 or the class of establishments notified by the Central Government and

- the number of employees should not be less than 20.

It also applies to any other establishment employing 20 or more persons which Central Government may, by notification, specify in this behalf. It is a residuary provision. It means, the Act may be made applicable by notification to any establishment – whether a factory or a non-factory and whether engaged in industry or otherwise.

Voluntarily, any establishment employing even less than 20 persons can be covered u/s 1(4) of the Act but notification is a sine qua non, which means the provisions of the Act cannot be enforced till notification in the official gazette is publishedfor voluntary coverage.

However, in case at any time the number of persons employed in an establishment to which this Act applies falls below twenty , even then such an establishment shall continue to be governed by this Act. As per Section 1(5) of the Act, an establishment shall continue to be governed by this Act once this Act applies to it in spite of the fact that at any time the number of persons employed therein falls below twenty.

Automatical Applicability Of The EPF Act

The interesting thing is that even if for one day, the establishment employs more than 20 persons, the Act applies to the establishment automatically from that date. The view that once the statutory requirements are fulfilled, the provisions of the Act take effect is supported by many a court judgement.

Meaning Of 20 OR More Persons in EPF Act

All persons employed in an establishment, whether drawing wages more or less than the statutory ceiling have to be taken into account to see whether the establishment satisfies the number of persons provided in the Section 1(3) of the Act. Where temporary employees are employed by an establishment as a part of the regular feature of employment, such employees cannot be construed as casual employees.

Profit Making Is No Criteria For Application Of The EPF Act

While considering applicability of the Act, the questions whether the establishing is having charitable activities or commercial activities or whether the establishment is earning profit or going into losses are immaterial.

Who Is Eligible To Become A PF Member?

The provisions of the Provident Fund Act, 1952,covers all types of employees, who are drawing salary / wages at the time of joining up-to Rs. 15,000/- per month. Also, the employees drawing salary / wages more than Rs. 15,000/- per month can also come under the purview of the EPF Act at the discretion of the management and by submitting a joint undertaking to the Provident Fund Commissioner;

The Act does not make any distinction between temporary and permanent workers or daily rated and piece rated employees. . Further, in case the casual workers are employed in or in connection with the work of the establishment, the said casual workers are also covered under the Employee Provident Fund Act from the date of their joining the establishment. Even, Badli are also covered.

The coverage under the Act is also provided to the employees employed by Contractors. As per Section 2(f) of the Act, persons employed indirectly through contractor are employees even though they are not directly employed by employer. There have been a number of judgement of High Courts in this regard.

Even Trainees employed by the establishment are covered under EPF through Provident Fund Act, 1952 in case it is found that nomenclature “Trainee” has been used to avoid statutory benefits.

Contribution To Employee Provident Fund (EPF)

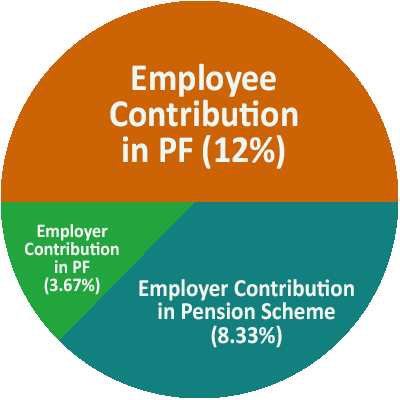

By Employee

12% of Salary

By Employer

12% of Salary – Out of 12% this employer’s contribution, only 3.67% goes towards P.F. and 8.33% goes to Employees Pension Scheme.

In a huge number of Private Companies, although contribution is paid in the above form, in practice, amount equivalent to such contribution is made a part of employees salary, which is known as Cost to the Company (CTC) and whole contribution of 24% towards EPF is borne by the employees.

As for as contribution towards pension is concerned, it cannot be more than Rs.1250/- per month, which amount in fact is 8.33% of the Rs.15,000, the amount of salary up to which provident scheme is mandatory. scheme is mandatory.

Changes In The Employees Contribution Towards Provident Fund Act (EPF) Brought By Finance Act, 2018

But in the union budget 2018, the EPF contribution rate for the newly recruited female employees has been reduced from 12% to 8% for first three years of their employment. The contribution from the employer’s end towards EPF, although, will continue to be @ 12%.

Further, for the new employees of all the sectors the Government will contribute 12% of their wages for the next three years to boost job creation

Increased Contribution

The contribution of 12% of is mandatory for an employee. But he may deposit more than this amount, which is called Voluntary Provident Contribution .One may give a mandate for a higher percentage of contribution. Contribution can be up to the 100% of the basic salary. This excess deposit is called by the name the Voluntary Provident Fund contribution.

Minimum Contribution Concession

Certain establishments have been given concession from the rule of 12% mandatory contribution and in such cases the applicable rate would be 10%. Such rule is applicable in the following cases:

- An establishment employing less than 20 persons;

- A company, which is declared sick by the Board for Industrial and Financial Reconstruction

- Any establishment having accumulated losses equal to or exceeding its entire net worth and

- Any establishment belonging to any of these sectors (a) Beedi (b) Brick (c) Coir (d) Guar gum Factories and (e)Jute.

Salary/Wages For The Purpose Of Contribution

Contribution of 12% is paid on Basic Wages .The definition of ‘basic wages’ under theEmployees’ Provident Funds & Miscellaneous Provisions Act, 1952 for the purposes of provident fund contributions has been the subject matter of debate for a very long time. The cash value of any food concession or allowances such as dearness allowance, house-rent allowance, over-time allowance or any other allowance payable to the employee in respect of his employment or of work done in such employment are not covered under the term “basic wages’. Similarly, commission, bonus or any presents made by the employer are also not included.

Withdrawals From Provident Fund

One may choose to withdraw EPF completely or partially. Recently, the Employees Provident Fund Organization has made withdrawals more flexible in the event of loss of job by a member. . Now, member will have the option to withdraw partially from their PF Account after one month of leaving the job or unemployment. The account holder will also be able to can keep his PF account active. The new rules of PF withdrawals provide for as follows:

- Earlier, the PF account holder could withdraw money after two months of unemployment and his account was closed. Under the relaxed withdrawal rules, an account holder will have option to withdraw 75 per cent of his accumulated funds as advance from their accounts after one month of unemployment with the result that he will be able to keep at the same time his accounts active. Thereafter, w the account holder gets a new job, he can transfer the money left in his account money to his new account with the new employer

- Further, under these new relaxed rules, a member will have the option to withdraw the balance 25% of his amount after completion of two months of unemployment and go for final settlement of his account.

However, one thing needs to be kept in mind is that, presently, a member is required to contribute to his PF account consecutively for at least 10 years for becoming eligible for pension. However, if a member closes his or her PF account two months after losing a job, he/she will not remain eligible for pension.

Procedure For Withdrawal From Provident Fund Account

Withdrawal from EPF Account can be done either by:

- Submitting of a physical application for withdrawal or

- Submitting of an online application

1. Submitting of a physical application

For the purpose, the individual one can download from thr EPFO site the new composite claim (Aadhar)/ composite claim form (Non-Aadhar) while no attestation from the employer is needed in the case of new composite claim form (Aadhar), same is required in the case of the new composite claim form (Non-aadhaar) before submitting to the respective jurisdictional EPFO office.

It may be noted that in the case of partial withdrawal of EPF amount by an employee for various circumstances, the requirement to furnish various certificates has been done away with recently and the option of self-certification has been introduced for EPF members.

2. Submission of an online application

In order to apply for withdrawal online, following conditions are to be met:

- UAN (Universal Account Number) allotted to the member is activated and the mobile number being used for activating the UAN is in working condition

- 2. UAN is linked with KYC of the Member i.e. Aadhaar, PAN and bank details

along with the IFSC code.

In case the above conditions are met, the requirement of an attestation from the previous employer for withdrawal of money can be done away with

Transfer Of Provident Fund

Whenever, an individual enters service in an organization, to which the Employees’ Provident Fund (EPF) Scheme, 1952 is applicable, he is registered for Provident Fund purpose and deductions are made every month from his salary as per rules applicable under this scheme. During initial periods of their service, young people keep on changing their service for better future growth or for other reasons, which may be with or without break in service. In such situations, there are two options before the individual:

- He can withdraw his own contribution with interest ,if he continues to be on break for up to 60 days; or

- He can transfer the balance standing to his credit to his account with the current employer

Here, it has to be noted that contributions towards this Provident Fund scheme are given exemption from income tax but any withdrawal of provident fund within 5 years of continuous service attracts income tax. Thus, from the tax point of view, it is suggested that it will be better to transfer the amount of provident fund to the account with the new employer than withdrawing the same.

Application For Transfer Of EPF Account – Form-13 (Revised)

For transfer of EPF Account, one is required to make use of Form 13 (Revised) provided under the the Employees’ Provident Fund Scheme, 1952. This application is required to be submitted by the individual to the present employer for onward transmission to the Commissioner, EPF, who is to give effect to the transfer. However, In the case of exempted establishments, the application needs to be sent by the employer directly to the P. F. Trust of the exempted establishment and a copy of the same to the RPFC concerned for details of the Family Pension membership.

Transfer of Provident fund through Offline Process

In case the Aadhaar number is not linked to the PF account or Universal Account Number (UANof the member and the verification is not completed by the previous employer, the PF transfer will be done offline. The online facility cannot be availed by the individual in such cases.Here the employee is required to fill up Form 13 and submit it to the new employer. Then the employer will submit this application in the EPFO office and the PF will get transferred in due course. In this case, he attestation from both the previous and the new employer is required.

Transfer of Provident fund online

For the purpose of transferring provident fund online, the following are to be ensured by the concerned member:

- The member is required to activate his Universal Account Number(UAN) on UAN portal and the mobile number, which is used for activation, should also be active.

- The Bank account and bank IFS Code of the concerned employee should be seeded against the Universal Account Number (UAN). However, Seeding Aadhar number and PAN against Universal Account Number (UAN)is not mandatory for raising transfer claims.

- The e-KYC should have been approved by the employer.

- Both the employers viz. the previous and the present employer should have been digitally registered authorized signatories in the EPFO

- Provident Fund account numbers of both the previous and the present employers of the employee should have been entered in EPFO database

- The acceptance can be of only one transfer request against the previous member ID.

- It is also necessary that Personal information as also information related to PF account shown in EPFO should be correct.

Online transfer of Employees’ Provident Fund

The Online transfer of Employees’ Provident Fund can be made as follows via

Member Portal:

- First of all a member, who desires to transfer his provident fund, is required to register on the Member Portal (http://www.epfindia.gov.in/) and check the eligibility criteria by selecting the ‘Check Eligibility for the purpose of submitting the Transfer Claim application in the portal.

- In case eligible, member may submit the Online transfer claim application, on the below link: http://www.epfindia.gov.in/Employee_OTCP.html

- Employee hasbeen given the option to have his/her claim form attested by the present or the previous employer. In case the present establishment is an exempt one (PF Trust), the claim can be submitted by an employee only through the present employer since as the Bank Account Number and IFS Code of the exempt trust is be required to be provided for transfer of PF amounts to the bank account of Trust.

- In case the PF account of the previous employer is held with the regional Provident office, completed form 13 will have to be submitted via the member portal (http://www.epfindia.gov.in). However, in the event of the previous account being maintained by a PF Trust, the employeeis required to submit a hard copy of the Transfer Claim Form (Form 13) for transfer the PF account and another copy of the Transfer Claim Form (Form 13) for transfer of the pension to the Corporate Shared Services (CSS) team by dropping the completed form in the CSS drop box, which is available at the work locations.

- Thereafter, the concerned employee is required to print a copy of the submitted transfer claim application in the member portal, sign the same and place it in the Corporate Shared Services drop box at his work location. After receipt of the signed hard copy of the Transfer form (Form 13), the employer (CSC) shall approve the online PF transfer application.

Partial Withdrawals

The Partial withdrawal from provident fund can be done under certain situations and subject to certain conditions as follows:

1. Withdrawal for Marriage

As per Para 68-K of the provident fund scheme,this facility may be availed of by an employee

- This facility may be availed by an employee for self, hischildren (son or daughter) or siblings (brother or sister).

- The available facility is up to 50% of employee’s share and interest in his/her provident account.account.

- During total period of service, this facility can be availed by an employee up to three times only.

- The facility for the first time can be availed after completing a minimum of seven years of service by an employee.

2. Withdrawal for Post Matriculation education of children

As per Para 68-K of the provident fund scheme,this facility may be availed of by an employee

- This facility may be availed by an employee for his children (son or daughter)

- The facility is for post matriculation education

- The available facility is up to 50% of employee’s share and interest in his/her provident account.account.

- During total period of service, this facility can be availed by an employee up to three times only.

- The facility for the first time can be availed after completing a minimum of seven years of service by an employee.

3. For buying or building a house for residential purposes OR buying a plot of land:

As per Para 68-K of the provident fund scheme,this facility may be availed of by an employee

- One has to be a Member of EPFO for at least five years to avail this withdrawal..

- A subscriber is allowed only one withdrawal for this purpose during his entire employment.

- Except a declaration by the subscriber, no other document is required to process this withdrawal.

For Purchase of Land

- up to 24 months of basic wages and DAor Total of employee and employer share with interest or Total cost. Whichever is least.

For purchase of house/flat/construction

- 36 months of basic wages and DA or Total of employee and employer share with interest OorTotal cost. Whichever is least

- The property should be held only in the name of the employee or in the name of his/her spouse or jointly by the employee with his/her spouse. There should not be any other joint ownership.

- In case the property is bought from an agency, the withdrawal amount shall be paid to the agency and for buying made from an individual or promoter, the amount shall be paid to the employee

4. Withdrawal for home loan repayment

This facility can be availed under Para 68-BB of the provident scheme by an employee

- This facility can be availed once during employee’s tenure of service, anytime after completing 10 years of service

- The property should be held in the of the employee name or in his/her spouse’s name or jointly between themselves.

- The amount of withdrawal shall be upto the member’s basic wages and dearness allowance for 36 months or his own share of contributions together with the employer’s share of contributions, with interest thereon or the total loan principal amount payable and interest, whichever is the lowest.

5. For renovating/repairing a house including making additions or removing parts of a house:

The withdrawal, as per Para 68-B of the provident fund scheme, can be done by an employee. the following are the aspects in this regard:

- The property should be registered only in the name of the employee or in the name of his/her spouse or jointly by the employee with his/her spouse. There should not be any other joint ownership.

- For additions, alterations substantial renovation or improvements – 12 months’ basic wages and DA OR

Employee Share with interest OR Cost Whichever is least.The withdrawal is allowed on completion of 5 years of service and is granted .

A further withdrawal up to twelve months’ basic wages and D.A. or member’s own share of contribution with interest thereon in his account, whichever is the least, may be granted for addition, alteration, improvement or repair of the dwelling house owned by the member or by the spouse or jointly by the member and the spouse, after 10 years of earlier withdrawal as above.

6. Purchasing of a dwelling house/flat or constructing a dwelling house from the Fund

This facility is available under para 68-BC of the Provident Fund Scheme

- This facility is in spite ofParagraph 68B or 68BB, as mentioned above,

- a member may purchase a dwelling house/flat, which includes a flat in a building owned jointly with others – whether outright or on hire-purchase basis – , or for constructing a dwelling house including the acquisition of a suitable site for the purpose

- The purchase should be from the Central Government, a State Government, or a Housing Agency under a Housing Scheme as notified by the Central Provident Fund Commissioner from time to time

- The amount shall not exceed not the subscriber’s and employer’s share of contributions with interest thereon or the cost of the acquisition of the proposed property whichever is less. :

- the member should have completed five years membership of the Fund; and

- At the time of withdrawal, the total accumulation in the employee;s PF account (or together with his/her spouse) including the interest, should be more than Rs 20,000/-.

7. Buying of dwelling house or flat or constructing a dwelling house – Withdrawal and financing from, the Fund

Notwithstanding anything contained in paragraph 68-B or 68-BB or 68-BC as mentioned above, a new provision under Para 68-BD in EPF Scheme, 1952, applicable from 12th April 2017, has been added to facilitate housing needs of members as per which withdrawals can be made by an employee for this purpose

- The subscriber is a member of a cooperative society or a society registered for housing purpose and such society should have at least ten members.

- The employee desires

- to buy a dwelling house or a flat owned jointly with others in a building out-right or on hire-purchase basis or

- to construct a dwelling house including acquiring a suitable site for the purpose from the government, Central or a State or any agency under housing scheme or any builder or promotor for the members.

- The amount of withdrawal shall be lesser of the two that is upto90per cent of the shares of contribution and interest thereon of employee and employer or the cost of the acquired proposed property.:

- the member should have completedthree years membership of the Fund; and

- The monthly instalment towards home purchase can also be paid from provident fund deposits but instalments will be directly paid to to the government, housing agency, primary lending agency or the bank concerned.

- In case the member fails to get allotted a flat or in the event of the cancellation of an allotment, the withdrawn amount has to be refunded in one lump sum within a period not exceeding fifteen days from the date of such cancellation or non-allotment.

- The rule applies to all those subscribers, who together with their subscriber spouse have at least Rs. 20,000 in their accounts.

8. For Medical Emergency

This facility can be availed under Para 68-J of the provident scheme by an employee

- The facility is for employee or his/her spouse or his/her children (son or daughter) or his/her dependent parents (father or mother).

- Non-refundable advance based on upto basic wages and dearness allowance for six months or employee’s share of contributions with interest thereon or the cost of the equipment, whichever is least.

- The facility is granted on the basis of self declaration, in cases of hospitalisation for at least a month, major surgery or in case they are suffering from T.B., leprosy, paralysis, cancer, heart problem.

- The facility can be arranged as many times as may be required during his tenure of employee’s service.

9. Withdrawal in case of closure or lockout of the establishment

This facility can be availed as per Para 68-H of the provident fund scheme by an employee

- Where in the establishment lockout or closure continuous beyond a period of 15 days.

- When the employee has not received wages forfor a period of 2 months or more

- The withdrawal shall be up to the total amount employee’s wages multiplied by the number of months of closure/lockout but subject to the condition that the employee holds a balance in his/her account that is employee’s share. For lockout/closure period beyond 6 months, the employee can also avail an advance from the employer’s share.

10. Withdrawal for Other purposes:

The withdrawals for other purposes can be on the following grounds

-

- Power cuts– Withdrawals on this aspect is applicable in case of employees whose wages were 75% or less than the total monthly wages as of Jan 1973. The Amount of withdrawalas an advance can be a month’s wages or Rs.300. In this case government-issued certificate stating power cut shall be required.

EPF advance in abnormal conditions and natural calamities

- This facility is granted under Para 68 L of the provident fund scheme

- Grant of advance is allowed in abnormal conditions and Natural calamities etc

- The advance can be can applied whenever need arises and even for the same purpose.

- The Maximum Amount allowed shall be 5000 or 50 per cent of employee’s own share of contribution

- The application for the purpose has to be given within 4 months.

11. Withdrawals for Handicapped employees :

This is provided under Para 68 N of the provident fund scheme

- For minimizing hardship on account of being handicapped, EPFO allows partial withdrawal to handicappedemployees for buying equipment.

- For the purpose, no minimum membership period is required.

- The withdrawal can be upto 6 month’s basic wages and DA or employee’s own share with interest or the entire cost of equipment whichever is least.

- pending court case of dismissal/retrenchment/discharge of employee

- The amount will be paid out to the employee

12. Partial Withdrawal prior to retirement

This is provided under Para 68 N of the provident fund scheme

- This facility is available under Para 68-NN of the provident fund Scheme

- For the purpose,no minimum service required but the individual should be of atleast 54 years of ageand should have left one year before retirement.

- The withdrawal can be only once and upto90% of total of both shares of employee and employer.

- Certificate from the employer shall neneeded showing the date of retirement

Composite Claim Form (Aadhaar ) As Well As (Non-Aadhaar)

With effect from 20.2.2017, the Employees Provident Fund Organization (EPFO) introduced ’s New Composite ClaimForms (Aadhar Based/ Non-Aadhar) for the purpose of PF Withdrawals with the result that PF Claim Forms 19, 10C and 31 (including UAN based forms) stood withdrawn. With the introduction of these forms, partial withdrawals can be taken on Self Certification basis, instead of providing other documents/ certificates.

While Composite Claim Form (Aadhar), which has replaced the existing Forms No. 19 (UAN), 10C (UAN) & 31 (UAN) with a view to simplify the submission of claim forms by subscriberscan be submitted to EPFO without attestation of the employer, the new Composite Claim Form (Non-Aadhar) has replaced the existing Forms No. 19, 10C & 31 to simplify submission of PF claim forms by subscribers, can be submitted by subscriber after attestation of employers to the EPFO.

Advantages/Benefits Of Employees Provident Fund Scheme

There are a number advantages/benefits of Employees Provident Fund Schene for the employees, which are as follows:

Tax-free Savings- Whatever amount is deducted from the salary of the employee in a financial year is deductible under Section 80C of the Income Tac Act, which makes the Investment Tax free.

Tax-free Earnings- The interest earned on the accumulations in the employee’s provident fund account is also tax free. Further, the withdrawals at the time of maturity/after 5 years of membership are also tax-free.

Withdrawal Benefit- During times of need/emergencies such as education, housing, medical, marriage etc. employee may withdraw funds from his account to meet such pressing needs.

Pension benefit- A part of employer’s share goes to employee’s pension fund and on completion of the age of 58 years, the employees becomes entitled to pension. In the case of death of a member, thefamily or Parents or nominee of Member can receive pension.

Insurance benefit – Similarly, a part of employer’s share iscontributed towards an employee’s life insurance, which ensures insurance for the employee.

Taxability Onearly Provident Fund Withdrawals

The Government encourages investment by the public and thus for making contribution towards provident fund account, the individual gets benefit by way of a deduction under Section 80 C of the Income Tax Act. On the other hand, the Government discourages pre-mature withdrawals from the provident fund and accordingly withdrawls from the Provident Fund balancewithout completion of five continuousyearsof servicehastaximplications. In such an eventuality, thetotal employer’scontribution amountalong with theinterestearned willget taxable in the year of withdrawal. Further,theamount ofdeduction claimed underSection 80C of the Income Tax Act on individual’s own contribution will be added to his income inthe year of withdrawal.Inaddition, theinterest earnedon such owncontribution will also be subject to tax. Thus, provident withdrawals are taxable under certain situations and exempt under the certain situations

The following table makes understand the taxability on withdrawal of provident fund:

| Sr.No. | Situation | Position of Taxability |

| 1 | Before Completion of 5 years continuous service

Amount withdrawn is less than Rs 50,000

Amount withdrawn is greater than Rs 50,000

If employment is terminated due to ill health of the employee The business of the employer is discontinued or the reasons for withdrawal are beyond the control of the employee. |

No Tax is deducted.at Source.

however, in case the individual comes in the the taxable bracket, he is required to show such provident withdrawal in his return of income

Tax is deducted at Source @ 10% if PAN is furnished; However, No Tax is deducted at Source, if Form 15G/15H is furnished.

No Tax is deducted at source. Further, as such withdrawal is exempt from tax, there is no need to show the same in the return of income. |

| 2 | Withdrawal of EPF after 5 years of continuous service. | No Tax is deducted at source.

Further, as such withdrawal is exempt from tax, there is no need to show the same in the return of income. |

| 3 | Transfer of PF from one account to another upon a change of job. | No Tax is deducted at source.

Further, as this is not a withdrawal, there is no need to show the same in the return of income. |

EPF For International Workers

The applicable law for governing social security for international workers (IWs) in India is the Employees’ Provident Funds Scheme, 1952 read with the Employees’ Provident Fund . In 2008, the coverage of employee provident fund benefits was extended by the Government of India to expatriates coming to India and working for Indian establishments. Through this initiative, the Government of India has entered into Agreement with several countries for the benefit of both the employers and employees to ensure that

- the employees of home country do not remit contribution in that country,

- get the benefit of totalisation period for deciding the eligibility for pension,

- may get the pension in the country where they choose to live, and

- the employers are saved from making double social security contributions for the same set of employees. In this regard, the Employees Provident Fund Organisation has been authorized for the purpose of issuing the Certificate of Coverage to the employees posted to the countries, which have signed Agreement with the Government of India.

Also Read about How to check EPF Universal Account Number ,How to Activate your UAN and Public Provident Fund